Investing in Gold and Silver

In 2024, silver offers higher growth potential due to rising industrial demand, while gold provides stability as a hedge against economic uncertainty.

Economic uncertainty almost always drives up the value of metals like gold. But with 2024 presenting unique challenges and opportunities, which is the smarter investment?

Silver or Gold? The answer depends on several factors, including market trends, risk tolerance, and long-term goals.

Gold Rush Katy, Houston keeps an eye on these trends so you don't have to. We know the gold and silver market well, and with our expertise and precise assessment technology, you will always receive the full value of your gold or silver. Come work with the experts to maximize your investment!

Key Takeaways:

-

Silver's industrial demand is growing, especially in tech sectors.

-

Gold remains a strong hedge against inflation.

-

Silver has shown higher recent returns compared to gold.

-

Gold is less volatile, offering more stability.

-

Investment choices should align with individual risk tolerance and financial goals.

Historical Performance of Gold and Silver

Over the past century, gold has steadily increased in value and remained a preferred safe haven for investors during economic downturns.

For example, from 1925 to 2020, the price of gold grew from $20.63 per ounce to $1,893.66, reflecting a compounded annual return of 4.87%.

Silver, on the other hand, has experienced more price volatility due to its dual role as both an investment and an industrial metal. Although its long-term growth hasn’t matched gold’s, silver’s price surged during economic expansions driven by industrial demand.

For instance, the price of silver rose from $0.68 per ounce in 1925 to $17.14 by 2020, with a 3.46% compounded annual return.

These returns, however, are modest when considering inflation, which averaged 2.9% over the same period.

Market Dynamics in 2024

Industrial Demand and Supply Factors

Silver is critical to several high-growth industries - particularly solar panel and electronics production.

Increased demand for green energy has driven the demand for silver in solar technology.

Additionally, the automotive industry's shift towards electric vehicles has further boosted silver's importance. However, supply shortages have become a significant concern and contribute to rising prices - creating a potentially lucrative opportunity for investors.

-

Solar panel production heavily relies on silver.

-

Electric vehicles are driving up silver demand.

-

Supply shortages are exacerbating price increases.

-

Global silver supply has been consistently declining.

-

Higher demand combined with low supply may lead to continued price increases.

Gold as a Safe Haven Asset

Gold has long been seen as a reliable hedge against economic uncertainty.

Investors flock to gold for its stability during market volatility.

Historically, gold has performed well during periods of high inflation and financial turmoil, providing a protective buffer against losses in other asset classes. This makes gold an appealing choice for those looking to safeguard their wealth during uncertain times.

Volatility and Risk Assessment

Price Volatility of Silver vs. Gold

Silver tends to be more volatile than gold. It is a riskier but potentially more rewarding investment.

Silver's price is influenced by its industrial demand, which can quickly and dramatically fluctuate based on global economic conditions.

Gold's price is more stable because it is largely driven by its status as a safe-haven asset.

-

Silver is more volatile due to industrial demand.

-

Gold is generally more stable.

-

Economic shifts can dramatically impact silver prices.

-

Short-term investments may favor gold for safety.

-

Long-term strategies might benefit from silver's growth potential.

Risk Tolerance and Investment Strategy

High-Risk Tolerance: Silver Investors

Investors with a high tolerance for risk might find silver more appealing.

The metal’s industry driven volatility presents opportunities for significant gains. However, it also means potential losses can be sharp and sudden.

Moderate Risk Tolerance: Balanced Approach

A balanced approach combining both gold and silver could be ideal for moderate risk investors.

This strategy allows investors to benefit from the stability of gold while also tapping into the growth potential of silver. It’s a way to hedge bets while staying open to higher rewards.

Low-Risk Tolerance: Gold Investors

Investors who prefer stability over high returns should lean towards gold.

Gold is less likely to experience sharp price drops. It is an investment that provides a sense of security in uncertain economic times.

Investment Options for Gold and Silver

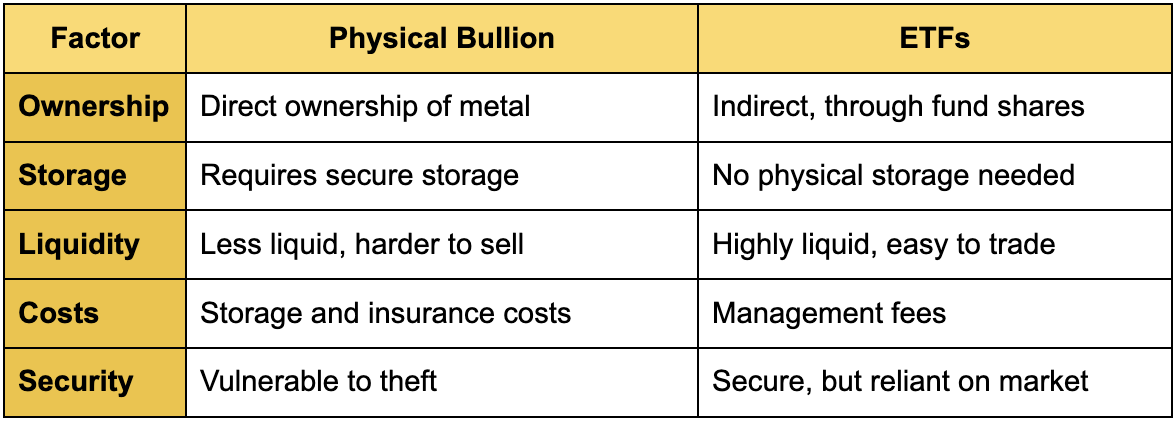

Physical Bullion vs. ETFs

An ETF (Exchange-Traded Fund) is a type of investment that allows you to buy shares in a diversified portfolio of assets, trading on stock exchanges like a regular stock.

Bullion refers to physical gold or silver in the form of bars or coins, which you can purchase and hold as a direct investment in precious metals.

Physical bullion gives you direct ownership of the metal. It does require secure storage and can be less liquid.

On the other hand, ETFs offer a more convenient and liquid way to invest, as they track the price of gold or silver without the need for physical storage. However, ETFs come with management fees.

Comparison Table: Physical Bullion vs. ETFs

Mining Stocks as an Alternative

Investing in mining stocks is another way to gain exposure to gold and silver without buying the metals directly.

Mining stocks can offer higher returns than bullion or ETFs because they provide leverage on metal prices. Mining companies often see their profits soar when gold or silver prices rise.

However, this comes with added risk.

Factors such as management decisions, mining costs, and geopolitical issues can significantly impact stock performance, making mining stocks a more speculative investment.

Conclusion: Is Silver or Gold the Better Investment in 2024?

Gold offers stability and acts as a reliable hedge against economic uncertainty. It's a solid choice for conservative investors looking for long-term security. Silver, on the other hand, presents higher growth potential, especially with rising industrial demand, but it comes with more volatility.

For those willing to embrace a bit more risk, silver might offer more rewarding returns.

Ultimately, both metals have their place in a well-diversified portfolio. Whether you're leaning towards the safety of gold or the growth potential of silver, Gold Rush is your trusted resource to sell gold and silver in Houston!

We want to buy your gold and silver. Our assessment process ensures you receive the full value of your items based on weight and purity. No one knows metals like Gold Rush. Visit today!